In his first budget bill, Gov. Tony Evers is seeking to increase expenditures out of the state’s main fund by $2.7 billion over two years, prioritizing spending on K-12 education, health care for the needy, prisons, and the University of Wisconsin System. To pay for it, the Democratic governor proposes a net increase in taxes and spending down a state surplus.

Gov. Tony Evers last week opened debate over the state budget by proposing new funding for key priorities such as public schools and Medicaid health programs. Leaders of the GOP-controlled Legislature immediately rejected much of the plan, signaling that the final 2019-21 budget is likely to take a far different form.

Still, it is worth taking a broad look at the governor’s proposal to see how it would affect the state’s spending, taxes, and overall financial health. It will be equally important to examine the Legislature’s eventual budget bill with the same lens. Both sides have proposed spending cuts or tax increases that would lead to a drawdown of the state’s budget surplus despite a relatively strong economy, leaving fewer reserves to deal with any future downturn.

The Governor’s Plan

Evers would increase spending in the state’s general fund, or main account, by 3.8% in fiscal year 2020 to $18.5 billion and by 7.4% in fiscal 2021 to $19.8 billion. This two-year increase of $2.7 billion in general purpose revenue (GPR) does not factor in additional spending of federal funds or money from separate state accounts such as the transportation fund.

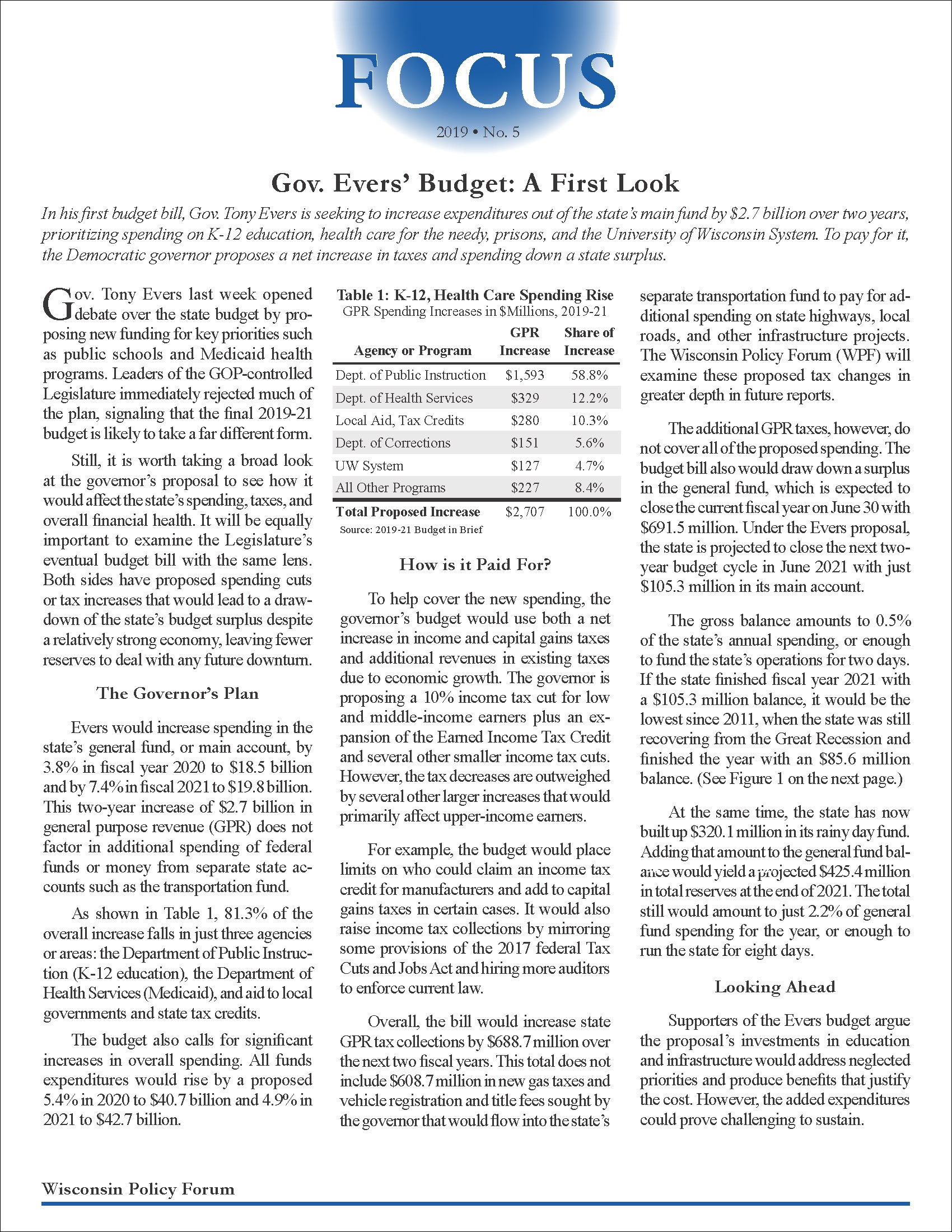

As shown in Table 1, 81.3% of the overall increase falls in just three agencies or areas: the Department of Public Instruction (K-12 education), the Department of Health Services (Medicaid), and aid to local governments and state tax credits.

| Agency or Program | GPR Increase | Share of Increase |

|---|---|---|

| Dept. of Public Instruction | $1,593 | 58.8% |

| Dept. of Health Services | $329 | 12.2% |

| Local Aid, Tax Credits | $280 | 10.3% |

| Dept. of Corrections | $151 | 5.6% |

| UW System | $127 | 4.7% |

| All Other Programs | $227 | 8.4% |

| Total Proposed Increase | $2,707 | 100.0% |

The budget also calls for significant increases in overall spending. All funds expenditures would rise by a proposed 5.4% in 2020 to $40.7 billion and 4.9% in 2021 to $42.7 billion.

How is it Paid For?

To help cover the new spending, the governor’s budget would use both a net increase in income and capital gains taxes and additional revenues in existing taxes due to economic growth. The governor is proposing a 10% income tax cut for low and middle-income earners plus an expansion of the Earned Income Tax Credit and several other smaller income tax cuts. However, the tax decreases are outweighed by several other larger increases that would primarily affect upper-income earners.

For example, the budget would place limits on who could claim an income tax credit for manufacturers and add to capital gains taxes in certain cases. It would also raise income tax collections by mirroring some provisions of the 2017 federal Tax Cuts and Jobs Act and hiring more auditors to enforce current law.

Overall, the bill would increase state GPR tax collections by $688.7 million over the next two fiscal years. This total does not include $608.7 million in new gas taxes and vehicle registration and title fees sought by the governor that would flow into the state’s separate transportation fund to pay for additional spending on state highways, local roads, and other infrastructure projects. The Wisconsin Policy Forum (WPF) will examine these proposed tax changes in greater depth in future reports.

The additional GPR taxes, however, do not cover all of the proposed spending. The budget bill also would draw down a surplus in the general fund, which is expected to close the current fiscal year on June 30 with $691.5 million. Under the Evers proposal, the state is projected to close the next two-year budget cycle in June 2021 with just $105.3 million in its main account.

The gross balance amounts to 0.5% of the state’s annual spending, or enough to fund the state’s operations for two days. If the state finished fiscal year 2021 with a $105.3 million balance, it would be the lowest since 2011, when the state was still recovering from the Great Recession and finished the year with an $85.6 million balance. (See Figure 1)

At the same time, the state has now built up $320.1 million in its rainy day fund. Adding that amount to the general fund balance would yield a projected $425.4 million in total reserves at the end of 2021. The total still would amount to just 2.2% of general fund spending for the year, or enough to run the state for eight days.

Looking Ahead

Supporters of the Evers budget argue the proposal’s investments in education and infrastructure would address neglected priorities and produce benefits that justify the cost. However, the added expenditures could prove challenging to sustain.

Under the proposal, net general fund spending in 2021 would exceed the fund’s revenues by $832.6 million. The imbalance would leave a potential shortfall, or structural deficit, of nearly $1.8 billion in the 2021-23 budget.

Legislative Republicans have not yet proposed a full budget of their own. However, GOP lawmakers last month also sought to spend down the state’s projected surplus, voting to cut income taxes by $490 million in 2021 and $338 million annually after that. Evers vetoed the legislation, which also would have made the 2021-23 budget harder to balance.